Detailed Technical Analysis for SIGN

Here’s a technical analysis for the SIGN framework for SIGN/USDT, tailored to current market conditions in September 2025, based on both chart principles and macro trends:

Chart Setup & Price Structure (Technical Analysis for SIGN)

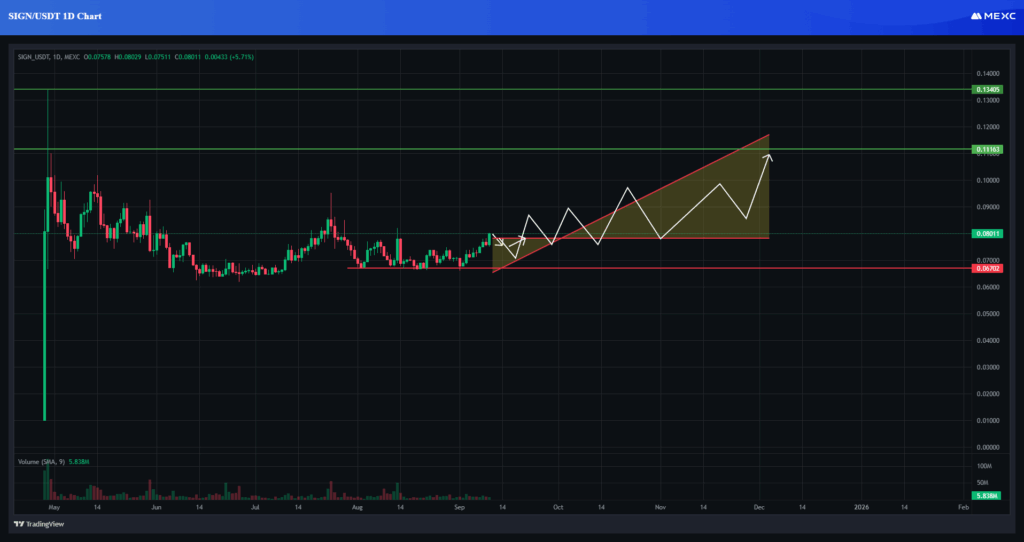

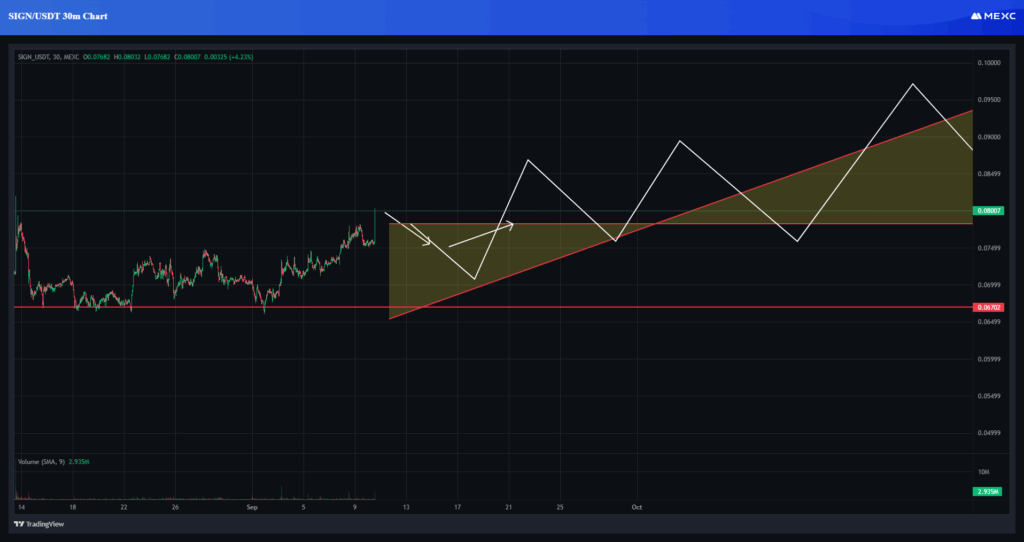

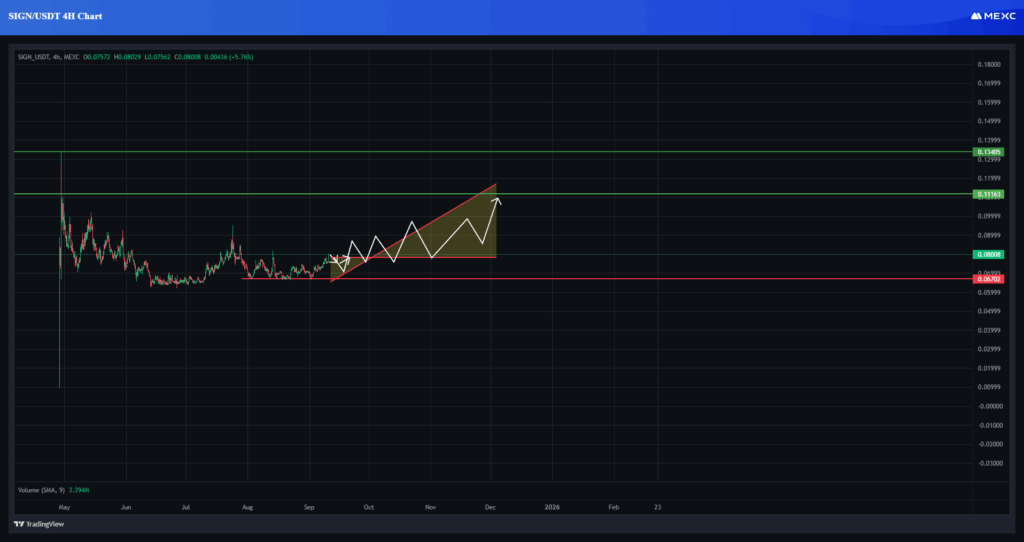

If SIGN is trading in a setup similar to the NGN or IGNIS charts you’ve shared, such as an ascending triangle or wedge pattern, here’s what to look for:

- Support Zone: Around $0.0672, where the price has bounced before.

- Resistance Levels: Near $0.124 and $0.154; these may act as breakout targets.

- Trend Pattern: A series of higher lows within a tightening range suggests bullish pressure is building.

Key Technical Indicators (Technical Analysis for SIGN)

| Indicator | Signal | Interpretation |

|---|---|---|

| 50/200 MA | Bullish crossover | Confirms long-term uptrend |

| RSI | 60–70 | Approaching overbought, but still bullish |

| MACD | Positive divergence | Momentum is building for a breakout |

| Volume | Increasing on green candles | Strong buyer interest |

Pattern Analysis

- Ascending Triangle: Suggests a breakout is likely if the price closes above resistance with volume.

- Measured Move Target: If a breakout occurs above $0.0854, the next target could be $0.18–$0.20, based on the triangle height.

Macro & Sentiment Factors

- Market Volatility: September 2025 has seen ETF outflows and expectations of a rate cut, which may increase crypto volatility.

- Altcoin Rotation: As Bitcoin faces seasonal weakness, capital may rotate into smaller-cap assets like SIGN.

- Token Unlocks: If SIGN has scheduled unlocks this month, it could affect short-term price dynamics.

Strategy Suggestions

- Entry: Near support ($0.072) or on breakout confirmation above $0.124.

- Stop Loss: Below $0.065 to protect against false breakdowns.

- Take Profit: Scale out at $0.154 and $0.180.

If you have a live chart for SIGN, I can help you interpret it more precisely. Or if you want, I can simulate a trading strategy based on this setup. Just let me know.

Do your own research.